Why Angels Invest and Why they Choose Tech

Why should those Rich Tech [People] Invest in your Film, Part 2/7

In order to understand why an investor should invest in your film, you need to understand why investors invest at all. What is an angel investor? What does it take to be a successful angel investor? Why don’t they just buy that Second Third yacht?

To answer the first question, an angel investor is person of means, who generally has a sizable amount of liquid assets and wants to do something more interesting and potentially lucrative than buying stocks or mutual funds. In order to be an accredited investor, an unmarried person must have made at least 200,000 USD for two consecutive years, and be likely to do the same in the current year. If they’re married, that number is more like 300,000 USD. They could also have 1,000,000 in liquid assets, not including their primary residence.

The reason this came about was to protect individuals from being taken by scam artists. The theory behind the income threshold is that if you’re that affluent, you would either have the education or sense to know if you’re being taken, or the means to hire someone who does.

Apart from the aforementioned asset requirement, what does it take to be a professional angel investor? It basically requires two things. Access to capital and deal flow. In layman’s terms, money to invest and projects to invest in. Most of the time, Investors generally assume that about half of their investments will tank and they’ll lose everything due to an inability of the company to exit.

So why do Angel Investors invest? This question is more difficult to answer and actually has several answers that we’ll explore throughout this blog series. But, essentially it boils down to the fact that These investments have the potential to breakout in a big way.

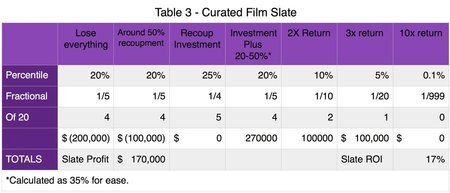

Below is a chart illustrating that point. It has been simplified and assumes very early-stage investments. This chart is generally based on loose feelings and assumptions asserted by many investors I’ve talked to. Just like it’s very difficult to estimate how many films break out, it’s very difficult to estimate how many investments are completely lost. It’s very easy to track winning bets, but much harder to track losing ones. This data is accurate to the dozens of investors I know as to their top-level assumption and the data around films is accurate to my experience as a distributor.

Before we get into any numbers, I should preface I’m not a financial advisor, this is not financial advice, nor am I soliciting for any particular project. This is all conjecture and an extrapolation and explanation of personal experience.

If you’re a filmmaker reading this, you might be thinking to yourself, why are they hunting mythical horses and WTF is a decacorn? A Unicorn is a company valued at more than 1 billion before exiting. If you’re a decacorn, your company is valued at more that 10 billion prior to exit. The reason that you don’t really see it on that pie chart is that it’s only about 1 in 1000 to 1 in 10,000 chance of happening.

So how do investors get their money back from a tech investment? in order for a tech investor to get their money back, generally the company has to be acquired, or go public [IPO.] Films on the other hand, simply need to find profitable distribution, or self-distribute the product. Each exit in each sector have its pros and cons, but in the end the boils down to which is more accessible. So what does the return look like in both cases?

Let's assume an investor invested One Million Dollars across 20 tech sector investments, each investment is made equally. I know that these tables are going to be hard to fully understand, so I’ll have a better data visualizations after table 3.

As you can see the overall ROI is about 85%, which means they nearly doubled their money on the entire portfolio. This is assuming that the investor isn’t completely green and has some idea of what they’re doing, so they make better picks. At some level, this looks very similar to the studio tentpole system. Experts making bets are confident that the ones that hit will cover the losses of the ones that miss. Unfortunately, the numbers don't back that up in the way we would like, partly due to the fact that most angels in the film stlate are not experts, and many filmmakers don't package as well as they should to maximize potential returns.

What does the picture look like for the investor going with no real knowledge of film look like? Well, from my more than a decade marketing and distributing features, here’s about how that would break out.

That’s not Pretty, but it is making a fair amount of negative assumptions about the slate of films. These numbers are assuming they don’t have distribution going in, don’t know what sells, and the film is financed entirely by private equity. The hypothetical investor made the investment at the outset of the project assuming the entirety of the risk. AND the film isn’t well cast with an eye for international sales.

BUT, if you structure your slate look to get at least a letter of intent for distribution a North American distributor and work with an international sales company to ensure the best casting for international saleability. It’s at least possible that you could have a slate that looks more like this.

That’s better, but a well-managed tech portfolio still obliterates it if we go solely by total return potential. The Graph I mentioned is below, to help illustrate my point. Trying to convince a tech investor to break from what they know to invest in something that has less potential to return is a hard sell.

Edit From the Website Transfer: If I were to re-do this, I would probably put the 10x return at more like 0.5-1% as opposed to 0.1%, assuming we account for one in 10 portfolios of 20 films gets a breakout hit, the potential average returns end up around 20-22% depending on which of the pool the breakout comes from. if 2 out of 10 of the portfolios happen to have a breakout it’s closer to an average return of 24-26%

Filmmakers, this is what you’re up against. But fear not, you may have an ace in the hole. In fact you may have more than one. The first ace in the whole is the speed of exit for film projects compared to that of tech startups. Due to that, film projects can return money to the investor faster than a startup would, which matters significantly in increasing the ability for an investor to re-invest and increasing the overall Annual Percentage Rate (or APR) of the investment. Check out part 3 linked below for more information on that.

Part 1:

Why Don’t those “Rich Tech [People]” invest in Your Film?

Part 2: (This Part)

Why Angels Invest, and Why they Choose Tech.

Part 3:

Examining APR: How does Film Stack up to Tech Portfolios?

Part 4:

Breakouts vs Decacorns

Part 5:

Diversification and Soft Incentives.

Part 6:

What’s really stopping Tech Investors from investing in Film?

Part 7:

How do you make a sustainable asset class out of film?

Thanks for Reading! The numbers in this blog have evolved since I wrote it, but only slightly. If you want to stay up to date on resources, livestreams, and other awesome content I have to offer, you should join my mailing list! You’ll stay up to date on all of my latest content, plus get a free e-book, monthly blog digests, and even a great resource package to help you talk to investors about your film. It’s totally free, so what are you waiting for?