The Basics of Financing your Independent Film with Tax Incentives

Making a profit on an indie film is HARD. If you can get your film subsidized by a tzx incentive your job is a lot easier. Here are the basics to get you started on that path.

Most filmmakers simply chase equity in order to finance their films. However, most investors don’t want to shoulder the financial risk involved in a film alone. That’s where tax incentives for independent film can come in and help to close the gap. But proper use of tax incentives for independent film financing is somewhat complicated. Here’s a primer to get you started.

Cities, States, Regions, and countries can have tax incentives

First of all, it’s important to understand that most forms of government can issue a tax incentive. In the US, the biggest and best incentives generally (but not always) come from states, however many cities, counties, and regions may supplement those incentives with smaller Internationally, many countries also provide some level of subsidy.

Europe Tends to provide better tax incentives than the US.

From the standpoint of the federal government, most European countries are much better about independent film subsidies than the US. Most of the time, these incentives take the form of co-production funding, but it’s relatively common for film commissions to provide grants to help promote the arts among their citizens.

This is particularly notable given that citizens of EU Member States can strategically stack incentives in a way that the majority of your film is financed via government subsidies. If, like me, you are based out of the United States, that’s just not possible due to the structure of most tax incentives.

There’s normally a minimum spend.

Especially in the US, there’s generally a fairly hefty minimum spend to qualify for a tax incentive. In some states that spending can start around 1 million dollars for out-of-state productions. Some states offer a lower cap for productions helmed by residents of the state.

There’s generally a minimum percentage of the total film budget needing to be shot there.

Most of the time you’ll only be eligible for a tax incentive if you shoot a certain percentage of your film or spend a certain percentage of your budget in a given territory. These can vary widely from territory to territory so look at the first place.

It’s normally not cash upfront

Unless you’re getting a grant from whatever film commission you’re shooting in, you’re probably just going to get a piece of paper that will state that you will be audited after the production and paid out according to the results of the audit. There are generally a few different ways that a tax incentive can be structured, but we’ll touch on those next week.

You need to plan for monetizing it.

In general, you’ll either end up selling the tax incentive for a percentage of its total value to a company with a high tax liability in your state, or you’ll have to take out a loan against your tax incentive in order to get the money you need to make the film. Both of these incur some level of cost which is different depending on which state you’re shooting in.

For example, Georgia and Nevada both have transferrable tax credits. Due to the large amount of productions going on in Georgia on a pretty much constant basis, the transferrable tax credit often monetizes at around 60% of face value. Nevada on the other hand has relatively few productions and many casinos that have very high tax burdens. As a result, the tax incentive in Nevada tends to monetize at around 90%. That said, there is presumably a more tested, experienced crew in Georgia than in certain parts of Nevada, of course, the film commission will tell you differently.

Not everything is covered

Not every expense for your film is covered. Exactly what is covered can vary widely from state to state, but in general only expenses that directly benefit the economy of the state are covered. There are often exceptions. One common exception is some mechanism to allow recognizable name talent to either be included in a covered expenditure or at least exempted from minimum thresholds of state expenditures.

Most of the time, high pay for above-the-line positions such as out-of-state recognizable name talent or directors are not covered covered by tax incentives. However, there are a few states that allow it. I talk a lot about it in this Movie Moolah Podcast with Jesus Sifuentes, linked below.

Related Podcast: MMP:003 Non-Traditional Investors & Maximizing Tax Incentives W/ Jesus Sifuentes

Not every program is adequately funded

Many film programs have a “cap” If that cap is too low, the money can be gone before the demand for the money is. Some states have the opposite problem.

Communicating with the film commission pays dividends long term

In general, the film commissions I’ve talked to are extremely friendly and easy to talk to. However, many times these commissions lose touch with the filmmakers they’re supporting shortly after they shoot. This isn’t necessarily a good thing, as most film commissions have significant reach into the greater film community and other aspects of local government. If you make sure they stay up to date as to what’s going on with your project you may find yourself getting help from unexpected places.

Also, if this is all a bit complicated, you should check out this new mentorship program I’ve started to help self-motivated filmmakers get additional resources as well as get their questions answered by someone working in the field. It’s more affordable than you may think. Check out my services page for more information.

If you’re not there yet, grab my free film Business Resource package. It’s got a lot of goodies ranging from a free e-book, free white paper, an investment deck template, and more. Grab it at the button below.

Finally, If you liked this content, please share it.

Click the Tags below for more, related content!

Which Investment Was More Profitable, Twitter or Paranormal Activity?

When films break out, do they make more money than tech companies? Here’s an examination of 2010s twitter and a fictional investment into the original paranormal activity.

Note from the Web Port: Not all blogs are evergreen. This has nothing to do with Elon Musk, or the state of the platform in 2023. This is an older blog I wrote to illustrate tech breakouts vs. film breakouts. The principle remains, but it’s aged a bit like fine milk. I’m leaving it up as a solid illustration though, since this is basically a 7 part thought experiment. If I were to do it again, I’d compare Skinamarink and Outbrain, Bumble, or DuoLingo. If I get some comments requesting it, I will. Probabably as a video.

BEGIN BLOG PORT

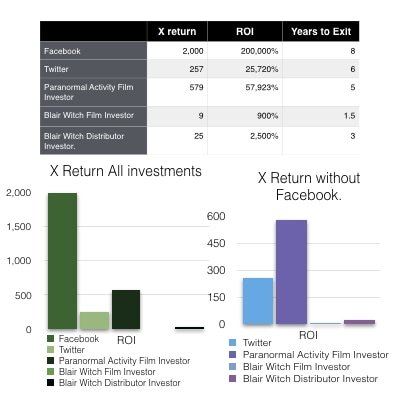

Every tech investor is looking for the next Snapchat, Twitter, or Facebook, and every filmmaker thinks their project will be the next The Blair Witch Project, Paranormal Activity, or Insidious. While there are lots of reasons this ideology is similar, they are far from the same. This week, we’re going to take a look at what an early stage investor in each of these projects or companies would have walked away with.

Films have breakouts, tech has Decacorns. While an interesting word, a Decacorn is easy to describe. It’s a company worth 10 billion or more pre-exit.

Defining a breakout film is somewhat more difficult. There are many ways one could describe a breakout film. In an article for the American Film Market Industry analyst Stephen Follows and Bruce Nash of The-Numbers.com defined it as a film budgeted between 500k and 3 million dollars that the returns to the producer were more than 10 million dollars.

Another way to look at it would be any film that returned their investors at least 10 times what they put in (10X) Perhaps with a minimum return around half a million dollars to avoid a 500 dollar film making 5,000 dollars being considered a breakout. Technically, the two examples of highest ROI films most people think of fall outside this realm.

We’ll be looking at the films people generally think of as winning investments, against the tech companies investors would love to have put some money in early on.

I’m sure every tech investor reading this is thinking a film investment doesn’t really stand a chance. In most instances, they’re right. However, purely as a thought exercise, let’s look at the numbers.

The seed round for Facebook was 500,000 Dollars, and if you’re an aspiring Venture Capitalist or a big fan of Darren Aronofsky, you know that largely came from Peter Thiel of Founders Fund. By the time he cashed out, his initial 500k investment netted him around 1 billion dollars. That’s a return on investment of more than 2,000X! Not all of the money went to him, but a significant portion did. That’s according to this CNN article.

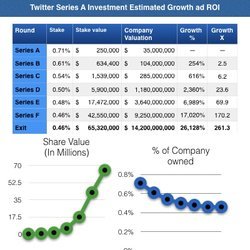

I couldn’t find another similar investment profile for Twitter. Perhaps because no one made a movie about it. So we’re going to have to extrapolate a bit, and estimate what a Series A Investor would have gotten from their investment using largely standard practices and math.

Crunchbase doesn’t have an exact amount that any individual invested, but since it was into a Series A round of 5 million dollars with 11 other investors several of them funds it’s reasonable that a single angel investor could have invested around 250k. Given that 250k investment was against a valuation of 35 million, that means this investor had owned 0.71% of Twitter.

Now, just because this nameless investor owned 0.71% of Twitter then, that doesn’t mean it stays at that percentage. Any time new stock is issued, that share dilutes. Given the valuations of future rounds, we can assume that the 0.71% of the company diluted to around 0.45% of the company by the time the company exited. Given that the company was evaluated at 14.2 billion dollars when Twitter IPO’s in 2013, the initial investment of 250k was worth 65.3MM. That means a 261X return

A 250X to 2,000X is a phenomenal possibility, and they're not the only tech companies to have offered such gigantic returns to their early investors. So how does film stack up?

Let’s look at the Blair Witch Project. According to this article from movienomics, the Blair Witch Project Sold at Sundance for 1 million USD. Since the Budget was only 22.5k, the filmmakers made a return of 4340%, or 43X. From the filmmaker side that’s not bad, but it’s not where the story is. Artisan, the company that bought the rights to the film, spent another 1 million US in a grassroots marketing campaign, and the film went on to gross 248 Million. That means they had around a 123X return on their 2 million dollar investment.

We’re going to look at this two ways. From being an investor in the film and an investor in Artisan. If you happen to be that rich uncle who ponied up the 22.5k, you probably would be entitled to around a 20% stake given that almost all of the crew on the Blair Witch worked for free. So, you investment would return about around 200k, or nearly 9X.

What if you were an investor in Artisan? On an entirely hypothetical and not entirely connected to reality basis, let’s just say you were an angel investor who got their money from inventing a new washing machine. You sold the invention to a big company and now you’re flush with cash. You’ve always liked movies so you invest 2 million in Artisan. In return, they give you 20% of their company. So, with that 2 million dollar investment, you get a return of about 25x. That’s a very healthy number.

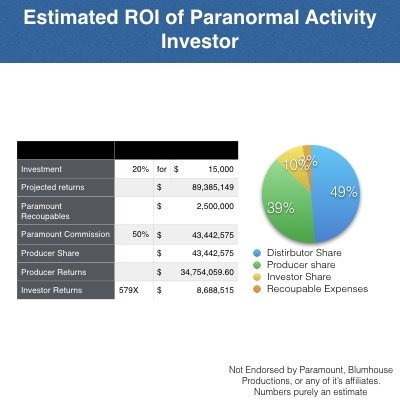

Paranormal Activity is such a low budget, the filmmakers almost certainly put it in themselves, however for the purposes of this exercise, we’re going to assume the entire 15k budget was put in by a single investor, and they took a 20% stake since the filmmakers clearly raised much more in soft costs including deferred payments and sweat equity.

Even though the first film in the paranormal activity series made about 89 million in theaters, not all of that went to the filmmakers. The theaters often keep around 50%, then the exhibitor takes another 30-50% of what’s left, and then the filmmakers and investors get a cut. Further, the distributors tend to recoup their costs first.

To simplify this, we’re assuming that around 50% of the costs go straight to the distributor, and that they recouped another 2.5 million on in expenses before they paid the filmmakers. That’s a low marketing spend, but the campaign Paramount did was very innovative and low cost.

So, if we assume everything above, 89 million gets reduced to a bit shy of 43.5 million once it reaches the Production Company. The investor is then paid out 8.7 million on their initial 15,000 dollar investment, which means a 579X ROI, roughly twice the ROI from the series A of Twitter!

So films are a better investment than Twitter, right? No. No they are not. Paranormal Activity is the highest ROI film of all time, Twitter isn’t the highest ROI tech company within 10 years on either side of it. Further, the returns I listed from Twitter are relatively well verified, I had to extrapolate the deal points for Paranormal activity based on different deal memos I’ve seen as a producer’s rep.

More than likely, the filmmakers put in the 15,000 dollar budget themselves. Even if they didn’t, given that paramount paid around 350,000 up front for Paranormal Activity, the the filmmakers wouldn’t have seen much more from it than that. After all, on paper Star Wars Return of the Jedi never broke even. If the filmmakers only got 350,000, then the investors ROI would have been more like 4.5X given that in our scenario, only owned 20% of the film.

Further, in the real world, both of these projects were largely backed by people who owned the project, and there would have been far more players in the waterfalls. So this is a fun throught experiment more than anything, and mainly proves the point that filmmakers should be focusing on other issues aside from potential ROI when selling their film.

Thanks for reading. This blog was a lot of work to port. If you’re browsing these archives and found it, you probably appreciate my work. If so, I’d ask you to sign up for my mailing list, support me on Patreon, or subscribe on substack. Thanks so much!

Why Angels Invest and Why they Choose Tech

Most Filmmakers need Investors to make their movies. To convince an investor to back in your indiefilm, you need to understand why they invest in anything,

Why should those Rich Tech [People] Invest in your Film, Part 2/7

In order to understand why an investor should invest in your film, you need to understand why investors invest at all. What is an angel investor? What does it take to be a successful angel investor? Why don’t they just buy that Second Third yacht?

To answer the first question, an angel investor is person of means, who generally has a sizable amount of liquid assets and wants to do something more interesting and potentially lucrative than buying stocks or mutual funds. In order to be an accredited investor, an unmarried person must have made at least 200,000 USD for two consecutive years, and be likely to do the same in the current year. If they’re married, that number is more like 300,000 USD. They could also have 1,000,000 in liquid assets, not including their primary residence.

The reason this came about was to protect individuals from being taken by scam artists. The theory behind the income threshold is that if you’re that affluent, you would either have the education or sense to know if you’re being taken, or the means to hire someone who does.

Apart from the aforementioned asset requirement, what does it take to be a professional angel investor? It basically requires two things. Access to capital and deal flow. In layman’s terms, money to invest and projects to invest in. Most of the time, Investors generally assume that about half of their investments will tank and they’ll lose everything due to an inability of the company to exit.

So why do Angel Investors invest? This question is more difficult to answer and actually has several answers that we’ll explore throughout this blog series. But, essentially it boils down to the fact that These investments have the potential to breakout in a big way.

Below is a chart illustrating that point. It has been simplified and assumes very early-stage investments. This chart is generally based on loose feelings and assumptions asserted by many investors I’ve talked to. Just like it’s very difficult to estimate how many films break out, it’s very difficult to estimate how many investments are completely lost. It’s very easy to track winning bets, but much harder to track losing ones. This data is accurate to the dozens of investors I know as to their top-level assumption and the data around films is accurate to my experience as a distributor.

Before we get into any numbers, I should preface I’m not a financial advisor, this is not financial advice, nor am I soliciting for any particular project. This is all conjecture and an extrapolation and explanation of personal experience.

If you’re a filmmaker reading this, you might be thinking to yourself, why are they hunting mythical horses and WTF is a decacorn? A Unicorn is a company valued at more than 1 billion before exiting. If you’re a decacorn, your company is valued at more that 10 billion prior to exit. The reason that you don’t really see it on that pie chart is that it’s only about 1 in 1000 to 1 in 10,000 chance of happening.

So how do investors get their money back from a tech investment? in order for a tech investor to get their money back, generally the company has to be acquired, or go public [IPO.] Films on the other hand, simply need to find profitable distribution, or self-distribute the product. Each exit in each sector have its pros and cons, but in the end the boils down to which is more accessible. So what does the return look like in both cases?

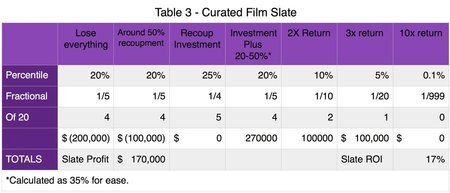

Let's assume an investor invested One Million Dollars across 20 tech sector investments, each investment is made equally. I know that these tables are going to be hard to fully understand, so I’ll have a better data visualizations after table 3.

As you can see the overall ROI is about 85%, which means they nearly doubled their money on the entire portfolio. This is assuming that the investor isn’t completely green and has some idea of what they’re doing, so they make better picks. At some level, this looks very similar to the studio tentpole system. Experts making bets are confident that the ones that hit will cover the losses of the ones that miss. Unfortunately, the numbers don't back that up in the way we would like, partly due to the fact that most angels in the film stlate are not experts, and many filmmakers don't package as well as they should to maximize potential returns.

What does the picture look like for the investor going with no real knowledge of film look like? Well, from my more than a decade marketing and distributing features, here’s about how that would break out.

That’s not Pretty, but it is making a fair amount of negative assumptions about the slate of films. These numbers are assuming they don’t have distribution going in, don’t know what sells, and the film is financed entirely by private equity. The hypothetical investor made the investment at the outset of the project assuming the entirety of the risk. AND the film isn’t well cast with an eye for international sales.

BUT, if you structure your slate look to get at least a letter of intent for distribution a North American distributor and work with an international sales company to ensure the best casting for international saleability. It’s at least possible that you could have a slate that looks more like this.

That’s better, but a well-managed tech portfolio still obliterates it if we go solely by total return potential. The Graph I mentioned is below, to help illustrate my point. Trying to convince a tech investor to break from what they know to invest in something that has less potential to return is a hard sell.

Edit From the Website Transfer: If I were to re-do this, I would probably put the 10x return at more like 0.5-1% as opposed to 0.1%, assuming we account for one in 10 portfolios of 20 films gets a breakout hit, the potential average returns end up around 20-22% depending on which of the pool the breakout comes from. if 2 out of 10 of the portfolios happen to have a breakout it’s closer to an average return of 24-26%

Filmmakers, this is what you’re up against. But fear not, you may have an ace in the hole. In fact you may have more than one. The first ace in the whole is the speed of exit for film projects compared to that of tech startups. Due to that, film projects can return money to the investor faster than a startup would, which matters significantly in increasing the ability for an investor to re-invest and increasing the overall Annual Percentage Rate (or APR) of the investment. Check out part 3 linked below for more information on that.

Part 1:

Why Don’t those “Rich Tech [People]” invest in Your Film?

Part 2: (This Part)

Why Angels Invest, and Why they Choose Tech.

Part 3:

Examining APR: How does Film Stack up to Tech Portfolios?

Part 4:

Breakouts vs Decacorns

Part 5:

Diversification and Soft Incentives.

Part 6:

What’s really stopping Tech Investors from investing in Film?

Part 7:

How do you make a sustainable asset class out of film?

Thanks for Reading! The numbers in this blog have evolved since I wrote it, but only slightly. If you want to stay up to date on resources, livestreams, and other awesome content I have to offer, you should join my mailing list! You’ll stay up to date on all of my latest content, plus get a free e-book, monthly blog digests, and even a great resource package to help you talk to investors about your film. It’s totally free, so what are you waiting for?

Why Should Those Rich Tech [People] Invest in your Film? [1/7]

Filmmakers often wonder why Investors don’t view film a serious potential investment. This 7 part blog series seeks to answer that question.

I recently went to an event here in San Francisco aimed at bringing together the more established filmmakers in San Francisco to build a better ecosystem for the industry up here. It’s a wonderful idea, a fantastic group of people, and the energy in the room was electric. However, there was one question that kept coming up that filmmakers had a lot of trouble understanding. Why won’t those rich tech people give us money?

This is something that I hear not only in the bay area. There’s a large contingent of Filmmakers in LA or elsewhere that would like to tap into Silicon Valley investment. The trouble is that the perception of film is that it's just a way to lose a lot of money. There are those of us looking to change that perception, however filmmakers need to understand that the overall potential for return is dwarfed when compared to other sectors. Whether that perception is true may be another matter.

This blog is not to disparage mean to discourage you, but to help you better understand the reality of your position. Understanding your position is key to obtaining your objective. To quote the Art of War…

In order to better understand the position of a tech investor, we need to look at how and why generally invest. As an entrepreneur who’s worked in both film and tech, an organizer of many film investment events, and a consultant who helps vet business plans for viability, I’m in a somewhat unique position to help answer that question. So I’m making this a series of 7 posts regarding every aspect of why a Tech investor would invest in a film.

I should clarify that this project is already a little bigger than I anticipated when I started writing it, so it’s going to be largely focused on Tech investment as opposed to sponsorship or any other sort of tech money entering film. I’ll be releasing them weekly, so check back every Wednesday. This post is to serve as a sort of landing page so you can look at all of the different aspects of why a tech investor would invest in a project. I’ll keep this updated, but here’s a loose table of contents that will eventually be linked. In the meantime, check out these other great resources. From me, Producer Foundry, and ProductionNext.

I should stress that the numbers found throughout these articles are inherently speculative, and largely from personal experience, and generalized research. Due to the fact that it’s only really possible to find data on the films and companies that made a return, estimating those that didn’t involve not a small amount of educated guesswork. Generally, the estimates in wins vs losses for films are based on personal experience in distribution, coupled with research and data from sites like IMDb Pro and The-Numbers.com. Tech portfolios are generalized based on research coupled with talks with several professional investors.

In short, these numbers are not meant to be scientific, but more some of the best analyses on this topic you’ll find online for free. If you have any thoughts or issues with these numbers, please feel free to comment below. I’d love an active thread, and I will monitor as much as time permits.

Here’s a handy dandy table of contents for your reference.

Part 2:

Why Angels Invest, and Why they Choose Tech.

Part 3:

Examining APR: How does Film Stack up to Tech Portfolios?

Part 4:

Breakouts vs Decacorns

Part 5:

Diversification and Soft Incentives.

Part 6:

What’s really stopping Tech Investors from investing in Film?

Part 7:

How do you make a sustainable asset class out of film?

If you liked this, you should check out my FREE Film Markets Resources pack. It’s got lots of things you’ll need to make talk to those rich tech people about your film, including a deck template, form letters, and even a free E-book called The Entrepreneurial Producer. Link below.

If this is all a bit much, and you need more individual attention, check out the guerrilla Rep Media Services page.

![Why Should Those Rich Tech [People] Invest in your Film? [1/7]](https://images.squarespace-cdn.com/content/v1/641c70c6404e8240d813222f/1680199708873-YN7V0FFBNHC5XFSN4UE4/tech-photos-002.jpeg)